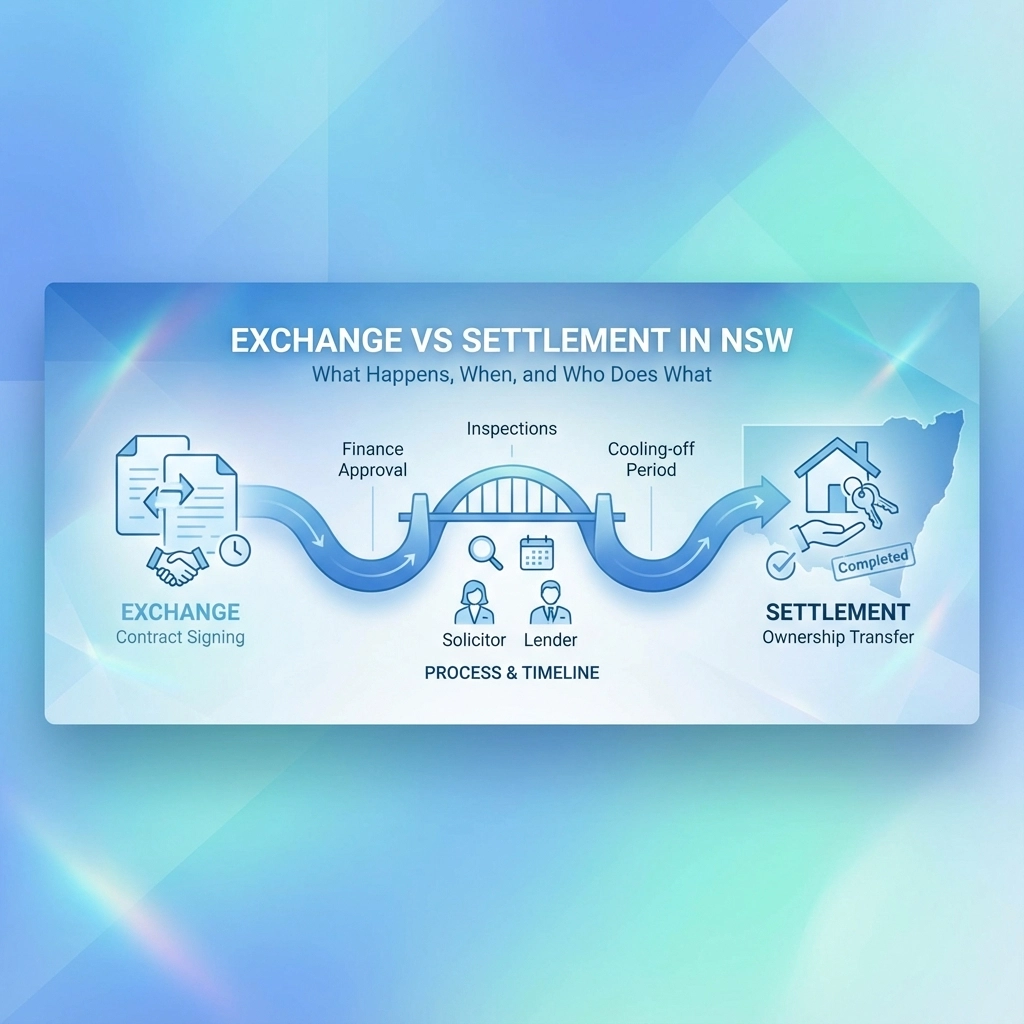

Exchange vs Settlement in NSW: What Happens, When, and Who Does What

Buying or selling property in NSW involves two critical milestones that often confuse first-time participants: exchange of contracts and settlement. While both are essential steps in the conveyancing process, they serve completely different purposes and occur weeks apart. Understanding what happens at each stage: and who's responsible for what: can save you stress, money, and potentially costly mistakes.

What is Exchange of Contracts?

Exchange of contracts is the moment your property transaction becomes legally binding. Before exchange, either party can walk away from the deal with minimal consequences. After exchange, you're committed to proceeding, and backing out can result in significant financial penalties.

During exchange, both buyer and seller sign identical copies of the contract. The buyer typically pays a deposit of 10% of the purchase price (though this can sometimes be negotiated down to 5%). This deposit demonstrates the buyer's serious intent and provides the seller with some security.

What is Settlement?

Settlement is the final stage where ownership actually transfers from seller to buyer. This is when the remaining purchase price is paid, the property title changes hands, and you get the keys. Settlement completes what exchange began: turning the legal commitment into actual ownership.

Unlike exchange, which involves signing documents, settlement is primarily about electronic transfers. Money moves from buyer to seller, mortgages are registered or discharged, and the property title is officially updated through NSW Land Registry Services.

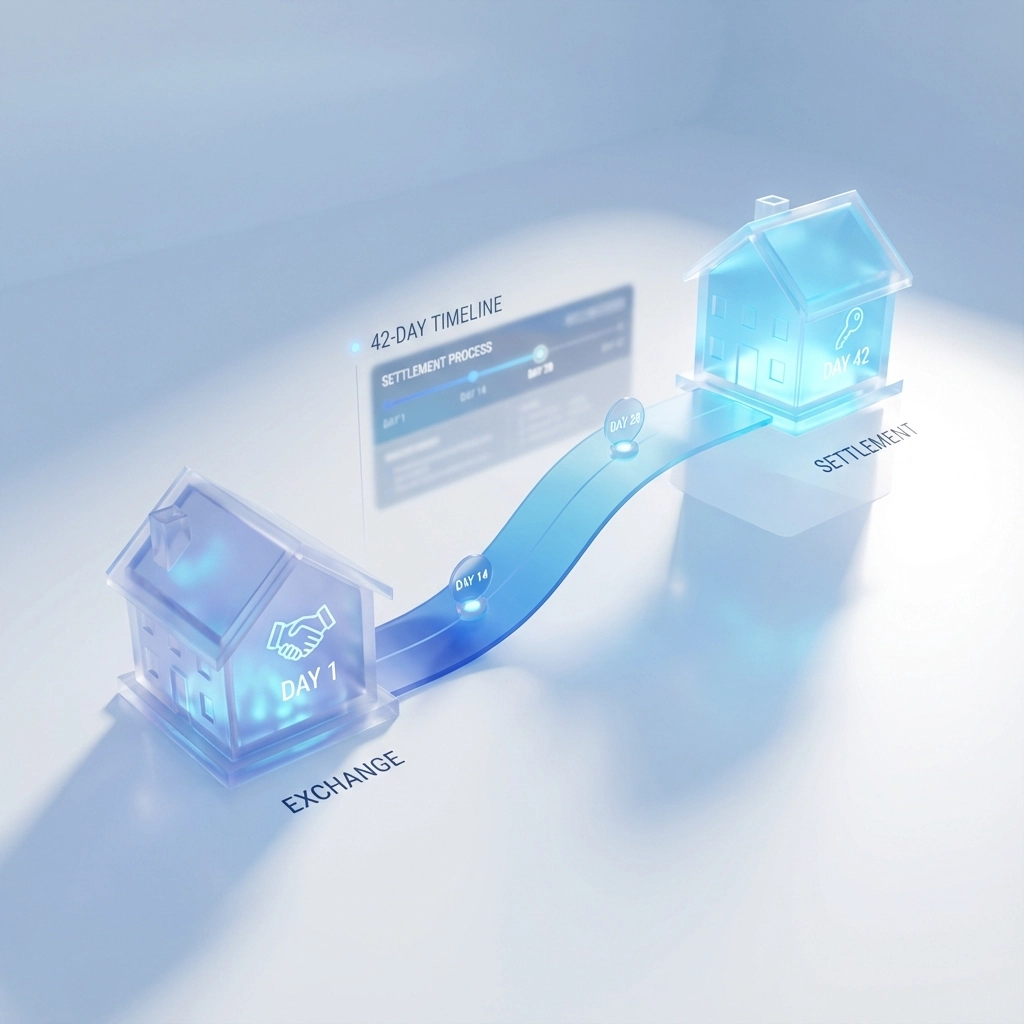

When Do Exchange and Settlement Happen?

In NSW, settlement typically occurs 42 days (6 weeks) after exchange of contracts. This timeframe can be negotiated longer or shorter depending on both parties' needs, but six weeks is standard practice.

The gap between exchange and settlement serves several purposes: • Gives buyers time to arrange final finance approval • Allows sellers to organize their move • Provides a buffer for any last-minute issues to be resolved • Enables all legal and administrative requirements to be completed

Some transactions may have shorter or longer settlement periods. For example, cash buyers might negotiate a 30-day settlement, while buyers needing more time to arrange finance might request 8-10 weeks.

What Happens During Exchange of Contracts?

Exchange involves several key steps that occur simultaneously:

Document Signing: Both parties sign identical contracts that outline all terms and conditions of the sale, including price, inclusions, special conditions, and settlement date.

Deposit Payment: The buyer pays the agreed deposit, which is typically held in the seller's conveyancer's trust account until settlement.

Cooling-Off Period Begins: Unless waived, buyers have a five-business-day cooling-off period after exchange. During this time, they can withdraw from the contract by paying a penalty of 0.25% of the purchase price.

Legal Commitment: Once the cooling-off period expires (or is waived), both parties are legally bound to complete the transaction on the agreed settlement date.

What Happens During Settlement?

Settlement day involves the electronic transfer of funds and documents through PEXA (Property Exchange Australia). Here's what occurs:

Final Financial Calculations: All adjustments are calculated, including council rates, water rates, strata levies (for units), and any rental income.

Funds Transfer: The buyer's remaining purchase money is transferred electronically to the seller. This typically involves the buyer's bank releasing mortgage funds and the buyer contributing any additional amount from their own resources.

Title Transfer: The property title is electronically transferred from seller to buyer through NSW Land Registry Services.

Mortgage Registration: If the buyer has a mortgage, it's registered against the property title simultaneously with the transfer.

Document Exchange: All necessary documents are exchanged electronically, including transfer documents, mortgage documents, and discharge documents (if the seller is paying off an existing mortgage).

Key Release: Once all electronic transfers are complete and confirmed, the selling agent releases keys to the buyer.

Who's Involved in Exchange and Settlement?

During Exchange: • Buyer and seller conveyancers: Prepare contracts, coordinate signing, and handle deposit transfer • Real estate agents: Often coordinate the exchange timing and witness signatures • Buyer and seller: Must be available to sign contracts (or provide power of attorney)

During Settlement: • Conveyancers: Manage all PEXA transactions and document lodgements • Banks and lenders: Release mortgage funds and register new mortgages • NSW Land Registry Services: Process title transfers • PEXA: Facilitates secure electronic transfer of funds and documents • Real estate agents: Release keys once settlement is confirmed complete

Key Differences Between Exchange and Settlement

Understanding these differences helps clarify your obligations and timeline:

Legal Status: Exchange creates a binding contract; settlement transfers ownership.

Financial Commitment: At exchange, buyers pay a deposit (10% typically); at settlement, they pay the remaining 90% plus adjustments.

Timing: Exchange can happen quickly once terms are agreed; settlement usually occurs 42 days later.

Flexibility: Before exchange, either party can walk away easily; after exchange, withdrawal carries significant penalties.

Process: Exchange involves physical or witnessed signing; settlement is entirely electronic through PEXA.

What Can Go Wrong Between Exchange and Settlement?

Several issues can arise during the 42-day period between exchange and settlement:

Finance Problems: If a buyer's loan approval is withdrawn or reduced, they may be unable to settle. This can result in contract termination and loss of deposit.

Property Damage: If the property is damaged between exchange and settlement (fire, flood, vandalism), specific contract clauses determine who bears responsibility.

Survey or Title Issues: Occasionally, boundary disputes or title problems emerge that weren't apparent at exchange.

Market Changes: While legally committed, buyers who experience buyer's remorse due to market conditions may try to find ways to exit the contract.

Vendor Default: Sellers might attempt to withdraw if they receive a significantly higher offer or experience their own settlement problems on their next purchase.

Planning for Both Milestones

Successful property transactions require careful planning for both exchange and settlement:

Before Exchange: Ensure all contract terms are clearly understood, finance pre-approval is solid, and you're genuinely ready to commit.

Between Exchange and Settlement: Finalize mortgage documentation, arrange building and pest inspections (if not already completed), organize removalists, and prepare for the final walk-through.

At Settlement: Be available for any last-minute queries from your conveyancer and ensure all funds are in place.

The 42-day period between exchange and settlement might seem lengthy, but it often passes quickly once you factor in mortgage processing, inspection scheduling, and moving arrangements.

For both buyers and sellers in NSW, understanding the distinct roles of exchange and settlement helps ensure a smoother transaction. While your conveyancer handles the legal complexities, knowing what to expect at each stage allows you to plan effectively and avoid common pitfalls that could jeopardize your property transaction.

If you're preparing for either exchange or settlement on the Northern Beaches or throughout NSW, professional conveyancing support can make the difference between a stressful experience and a seamless property transfer. Contact us to discuss how we can guide you through both milestones with confidence.